Discrepancies between Amazon Invoice and E-Invoice

Dear Seller Community,

I hope this message finds you well. I would like to draw your attention to an issue that has recently come to my notice regarding discrepancies between Amazon invoices and e-invoice amounts.

Following Amazon's announcement of the transition from GSP provider Vay Network Services Private Limited to Cygnet Infotech Private Limited for e-invoices, I have observed discrepancies ranging from 1 to 2 paise between the invoice amount and the actual e-invoice amount.

Despite raising this concern with the Seller Support team on April 18th, there has been no action taken thus far. Instead, I continue to receive generic responses stating that they are working with the internal team.

To assist fellow sellers in identifying these discrepancies in their accounts, I recommend two methods:

1. Using QR Code:

- Go to the "Manage Orders" tab.

- Locate any business customer order and print the tax invoice.

- Scan the QR code using a mobile app scanner.

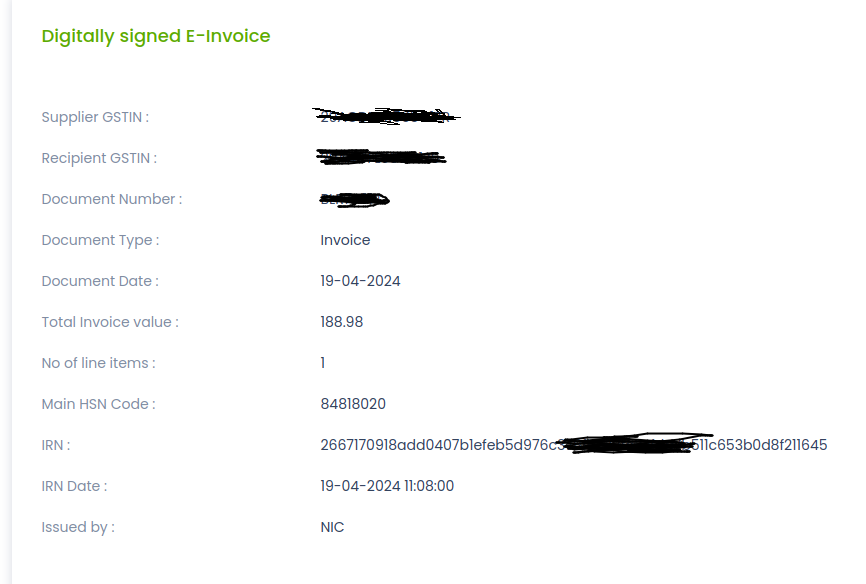

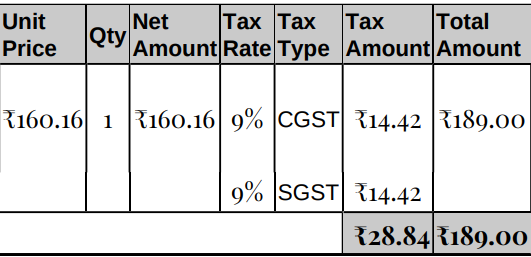

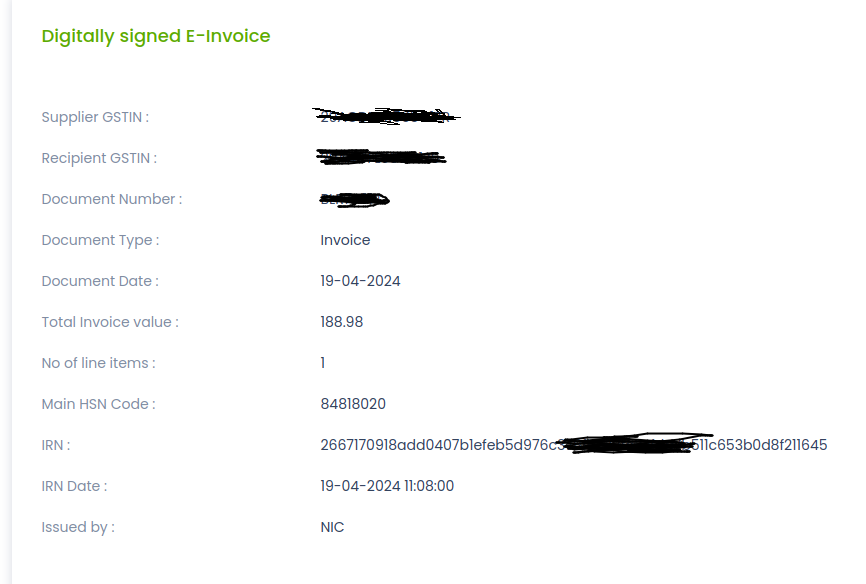

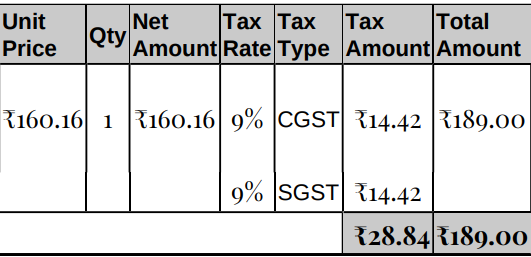

- Copy the data and paste it into the verification tool at einvoice6.gst.gov.in/verify-qrcode.

- Compare the invoice amount with the QR code invoice amount.

2. Using Amazon E-Invoice Portal:

- Go to the "Manage Orders" tab.

- Find any business customer order and print the tax invoice.

- Log in to your e-invoice portal and enter the Amazon issued bill number.

- Compare the final amount displayed with the invoice amount.

I urge you all to support this post so that Amazon takes immediate action. Mismatches between Amazon invoices and e-invoice records could lead to issues with GST return filing. It is essential for our businesses that these discrepancies are addressed promptly.

Discrepancies between Amazon Invoice and E-Invoice

Dear Seller Community,

I hope this message finds you well. I would like to draw your attention to an issue that has recently come to my notice regarding discrepancies between Amazon invoices and e-invoice amounts.

Following Amazon's announcement of the transition from GSP provider Vay Network Services Private Limited to Cygnet Infotech Private Limited for e-invoices, I have observed discrepancies ranging from 1 to 2 paise between the invoice amount and the actual e-invoice amount.

Despite raising this concern with the Seller Support team on April 18th, there has been no action taken thus far. Instead, I continue to receive generic responses stating that they are working with the internal team.

To assist fellow sellers in identifying these discrepancies in their accounts, I recommend two methods:

1. Using QR Code:

- Go to the "Manage Orders" tab.

- Locate any business customer order and print the tax invoice.

- Scan the QR code using a mobile app scanner.

- Copy the data and paste it into the verification tool at einvoice6.gst.gov.in/verify-qrcode.

- Compare the invoice amount with the QR code invoice amount.

2. Using Amazon E-Invoice Portal:

- Go to the "Manage Orders" tab.

- Find any business customer order and print the tax invoice.

- Log in to your e-invoice portal and enter the Amazon issued bill number.

- Compare the final amount displayed with the invoice amount.

I urge you all to support this post so that Amazon takes immediate action. Mismatches between Amazon invoices and e-invoice records could lead to issues with GST return filing. It is essential for our businesses that these discrepancies are addressed promptly.

1 reply

Seller_W7LkAkUxFofUt

I Support the post. @Amazon team, please resovle asap