Signature for Tax Interview During Transition from Sole Proprietor to LTD Company

I’m in the process of transitioning my Amazon seller account from a sole proprietorship, currently under my personal name, to a UK-based limited company. I'm updating my tax information via the Tax Interview section in Seller Central. When it comes to the signature section at the end of the tax interview, I am unsure whether to sign with my personal name, as the director of the company, or to use the name of my company.

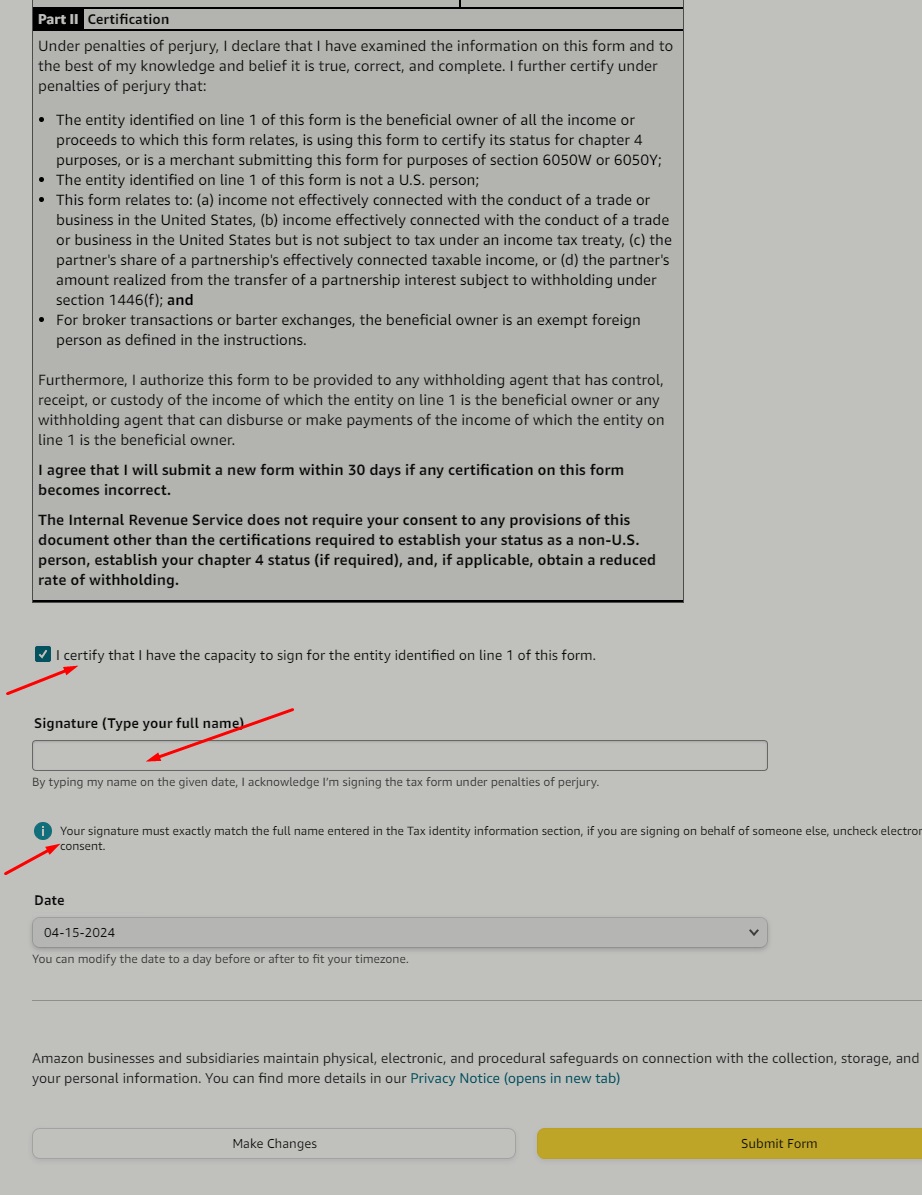

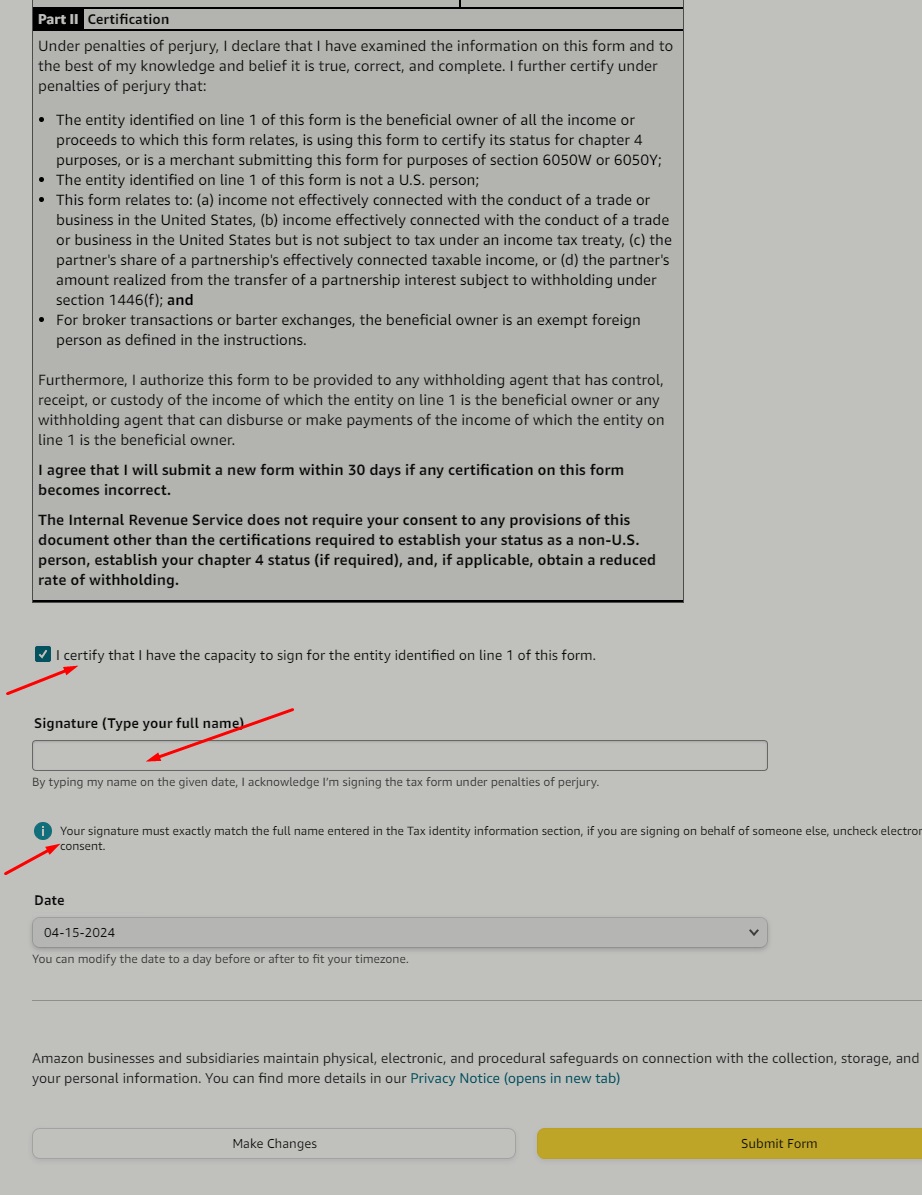

The instructions state that the signature must exactly match the full name entered in the Tax identity information section. Since I used the company name ACILD Ltd is the name in the 'Name of organization' field, it implies that should be the name in the signature section. However, it also notes that if I am signing on behalf of someone else, I should uncheck electronic signature consent, suggesting that an individual’s name might be necessary here, see image below.

Can you please guide me on this to ensure a smooth transition.

Thanks

Signature for Tax Interview During Transition from Sole Proprietor to LTD Company

I’m in the process of transitioning my Amazon seller account from a sole proprietorship, currently under my personal name, to a UK-based limited company. I'm updating my tax information via the Tax Interview section in Seller Central. When it comes to the signature section at the end of the tax interview, I am unsure whether to sign with my personal name, as the director of the company, or to use the name of my company.

The instructions state that the signature must exactly match the full name entered in the Tax identity information section. Since I used the company name ACILD Ltd is the name in the 'Name of organization' field, it implies that should be the name in the signature section. However, it also notes that if I am signing on behalf of someone else, I should uncheck electronic signature consent, suggesting that an individual’s name might be necessary here, see image below.

Can you please guide me on this to ensure a smooth transition.

Thanks

3 replies

LeviDylan_Amazon

Hello @Seller_EM5ZbzEQmHa3v,

Thank you for posting questions about your account on the Seller Forums.

"I’m in the process of transitioning my Amazon seller account from a sole proprietorship, currently under my personal name, to a UK-based limited company. I'm updating my tax information via the Tax Interview section in Seller Central. When it comes to the signature section at the end of the tax interview, I am unsure whether to sign with my personal name, as the director of the company, or to use the name of my company."

I see that you have questions regarding taxes. For this, I am engaging a Community Manager to review this situation further.

If you have any further questions or updates to provide, please feel free to utilize this thread. The Forums community and I are here to support you.

Wishing you the best,

LeviDylan

Charly_Amazon

Hello @Seller_EM5ZbzEQmHa3v

Thank you for your message, were you able to submit the form already ?, if you still have the doubt, I would suggest that your raise this inquiry to our Seller Support Department, due to the nature of it and also they can review your whole account as well and the recent changes being performed.

You can do so by opening a case here.

Charly_Amazon