Apply for VAT Exemption

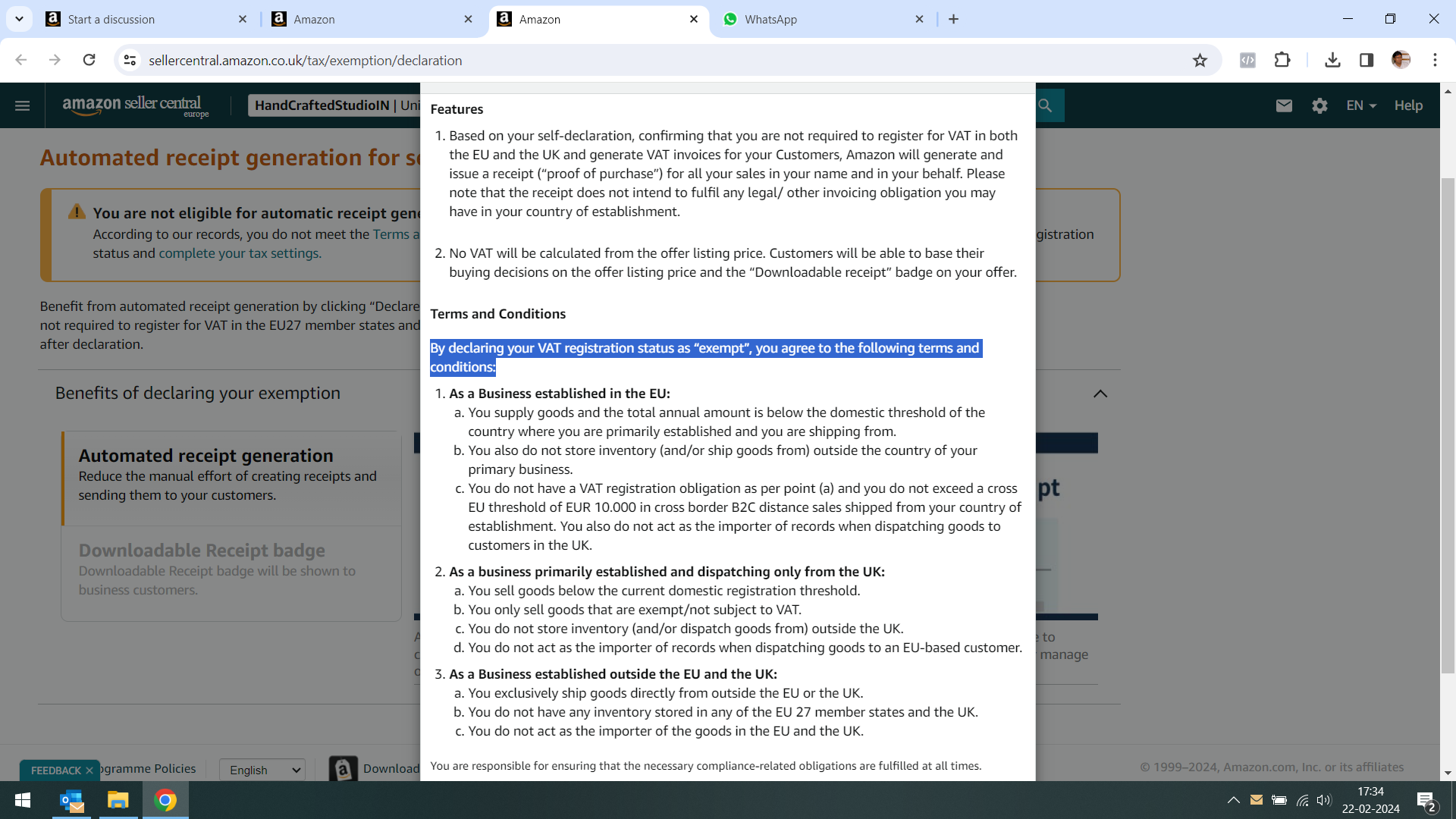

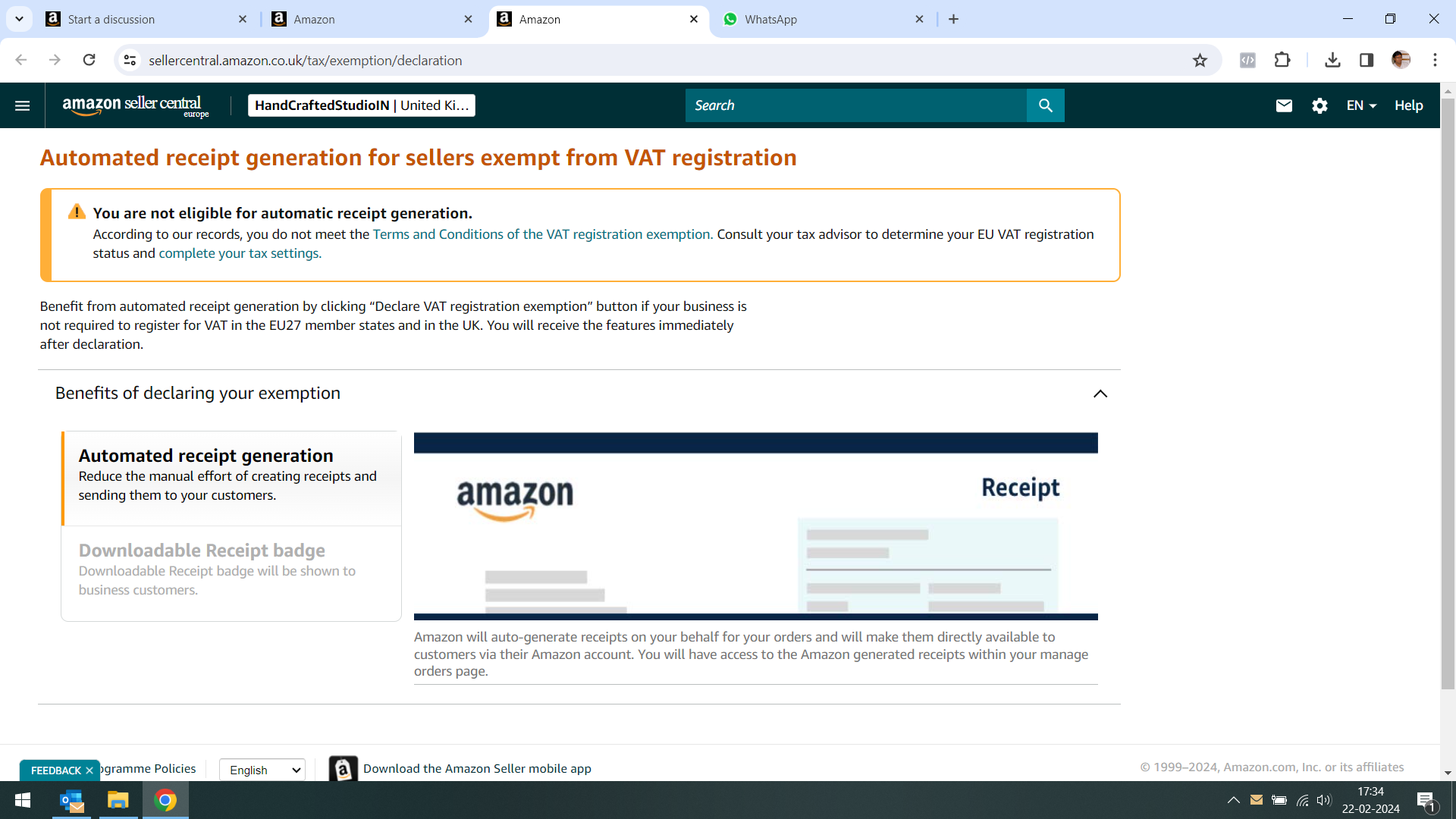

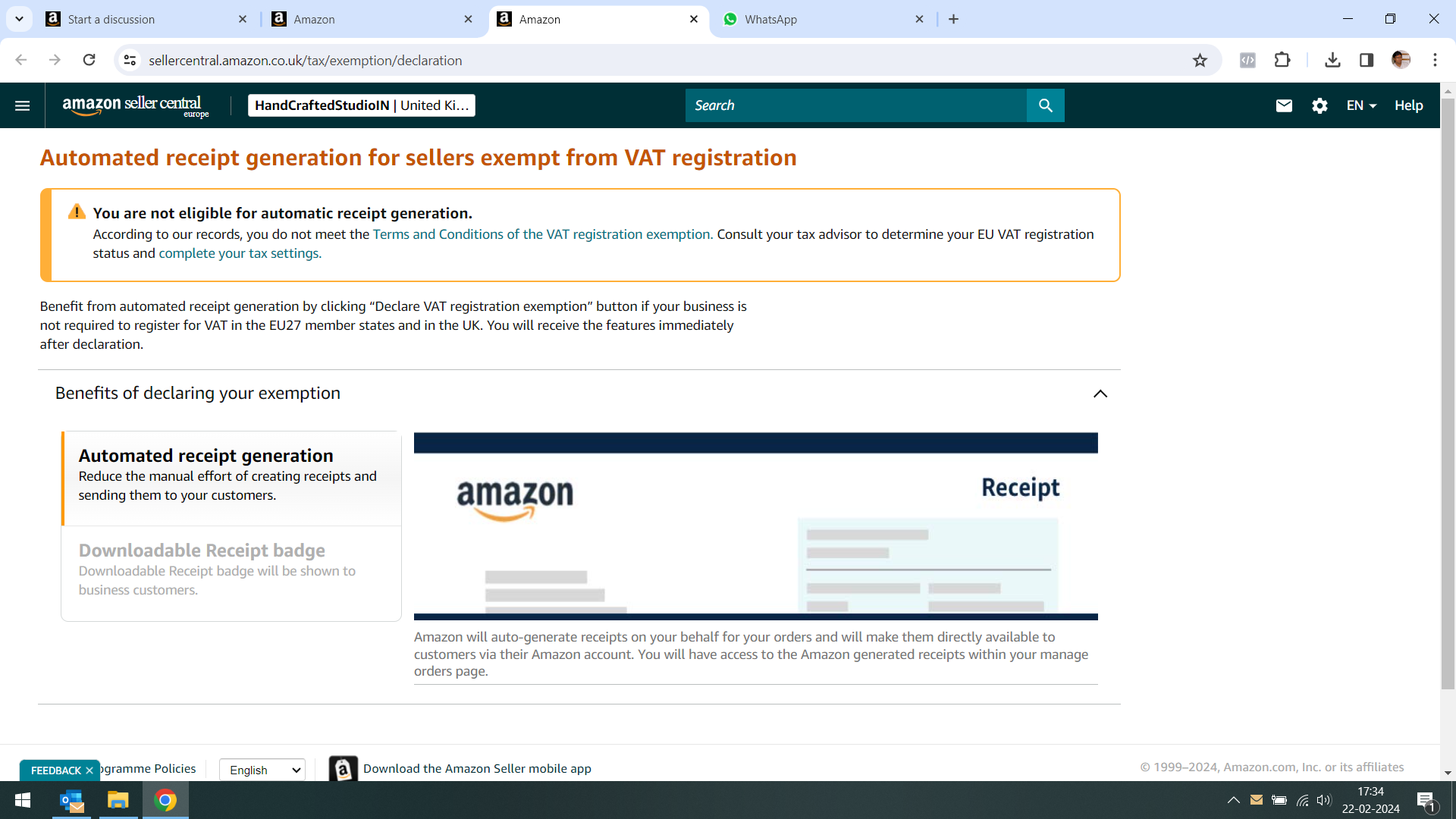

I am a seller based out of India. I do not do FBA and I am not VAT registered in UK. Still I am unable to apply for VAT exempt. When I try to apply for VAT exemption then it shows a message "You are not eligible for automatic receipt generation.

According to our records, you do not meet the Terms and Conditions of the VAT registration exemption. Consult your tax advisor to determine your EU VAT registration status and complete your tax settings."

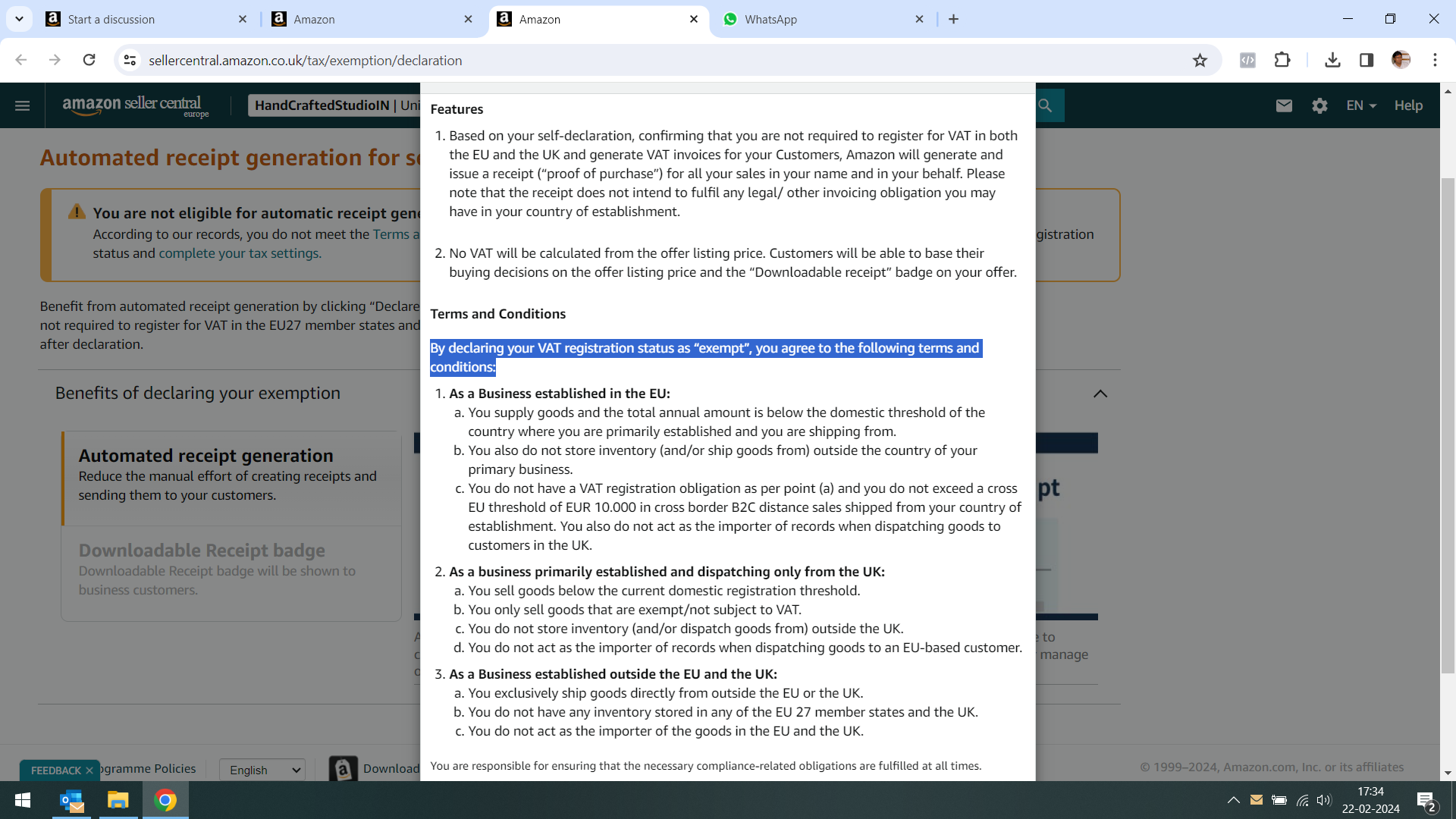

When I see the Terms and Conditions, it says

By declaring your VAT registration status as “exempt”, you agree to the following terms and conditions:

As a Business established outside the EU and the UK:

You exclusively ship goods directly from outside the EU or the UK.

You do not have any inventory stored in any of the EU 27 member states and the UK.

You do not act as the importer of the goods in the EU and the UK.

So, as per the above terms, I am eligible for VAT exemption still the system does not allow me to apply for VAT Exemption.

Can anyone help me in this regards?

Apply for VAT Exemption

I am a seller based out of India. I do not do FBA and I am not VAT registered in UK. Still I am unable to apply for VAT exempt. When I try to apply for VAT exemption then it shows a message "You are not eligible for automatic receipt generation.

According to our records, you do not meet the Terms and Conditions of the VAT registration exemption. Consult your tax advisor to determine your EU VAT registration status and complete your tax settings."

When I see the Terms and Conditions, it says

By declaring your VAT registration status as “exempt”, you agree to the following terms and conditions:

As a Business established outside the EU and the UK:

You exclusively ship goods directly from outside the EU or the UK.

You do not have any inventory stored in any of the EU 27 member states and the UK.

You do not act as the importer of the goods in the EU and the UK.

So, as per the above terms, I am eligible for VAT exemption still the system does not allow me to apply for VAT Exemption.

Can anyone help me in this regards?

0 replies

Seller_Nprc5XWvdLYk9

Are you selling to the UK?

And if you are - surely when a customer buys from you - you (the seller) are the importer of the goods - as you are paying the import duties?

Seller_ZJhFeE3tNKzfh

Have you tried consulting your tax advisor?

Also where are you seeing that amazon remits import duties on all orders? If they are, I'm opening up my export channels Monday!

Sakura_Amazon_

Hello @Seller_MO8OX4PGCBVRf,

This is Sakura from Amazon.

Did you check your doubts with the Seller Support Team? However, in this case, you might need to contact a tax advisor to review this.

@Seller_Nprc5XWvdLYk9 and @Seller_ZJhFeE3tNKzfh , thank you for your involvement here.

Regards,

Sakura