Profit or Loss?

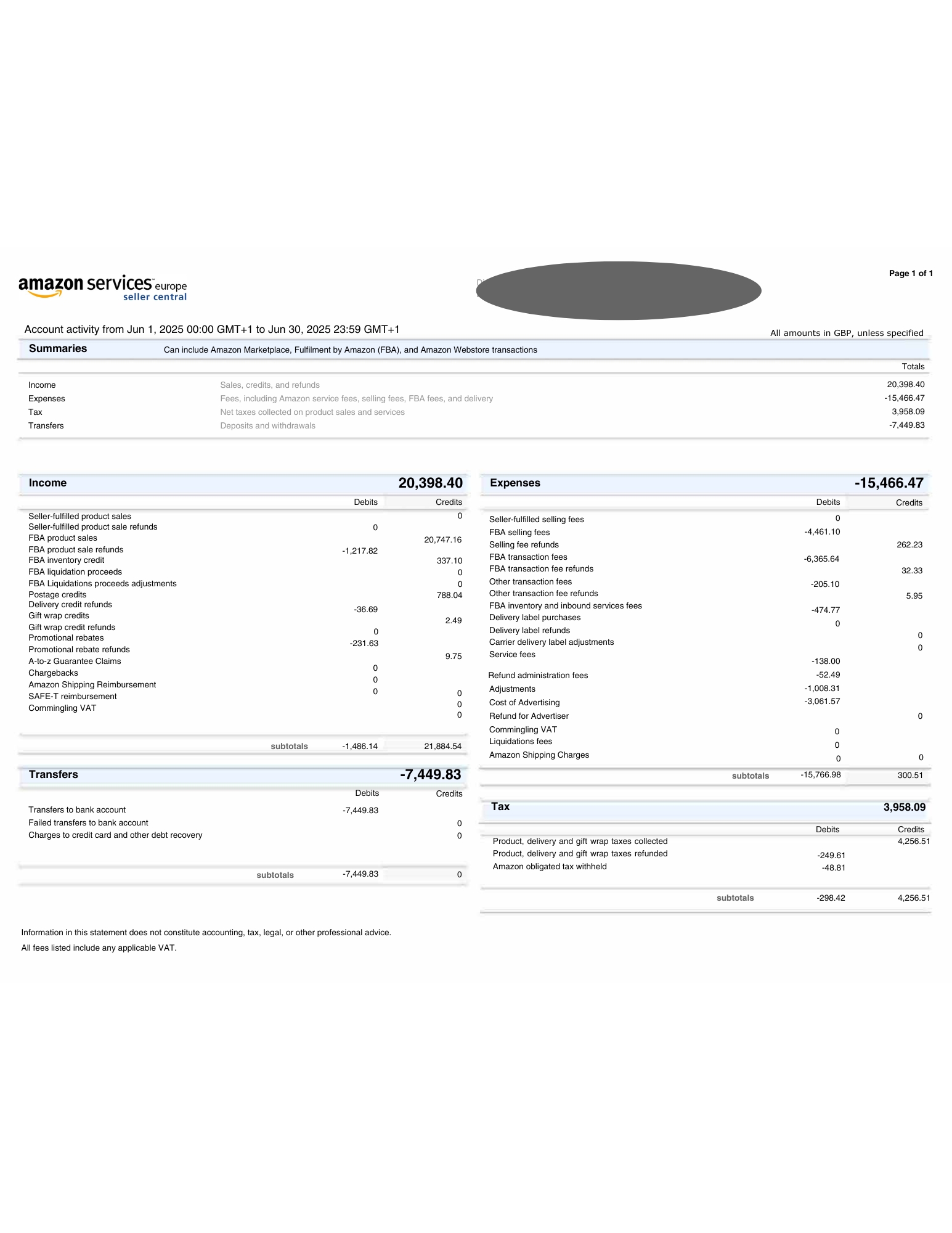

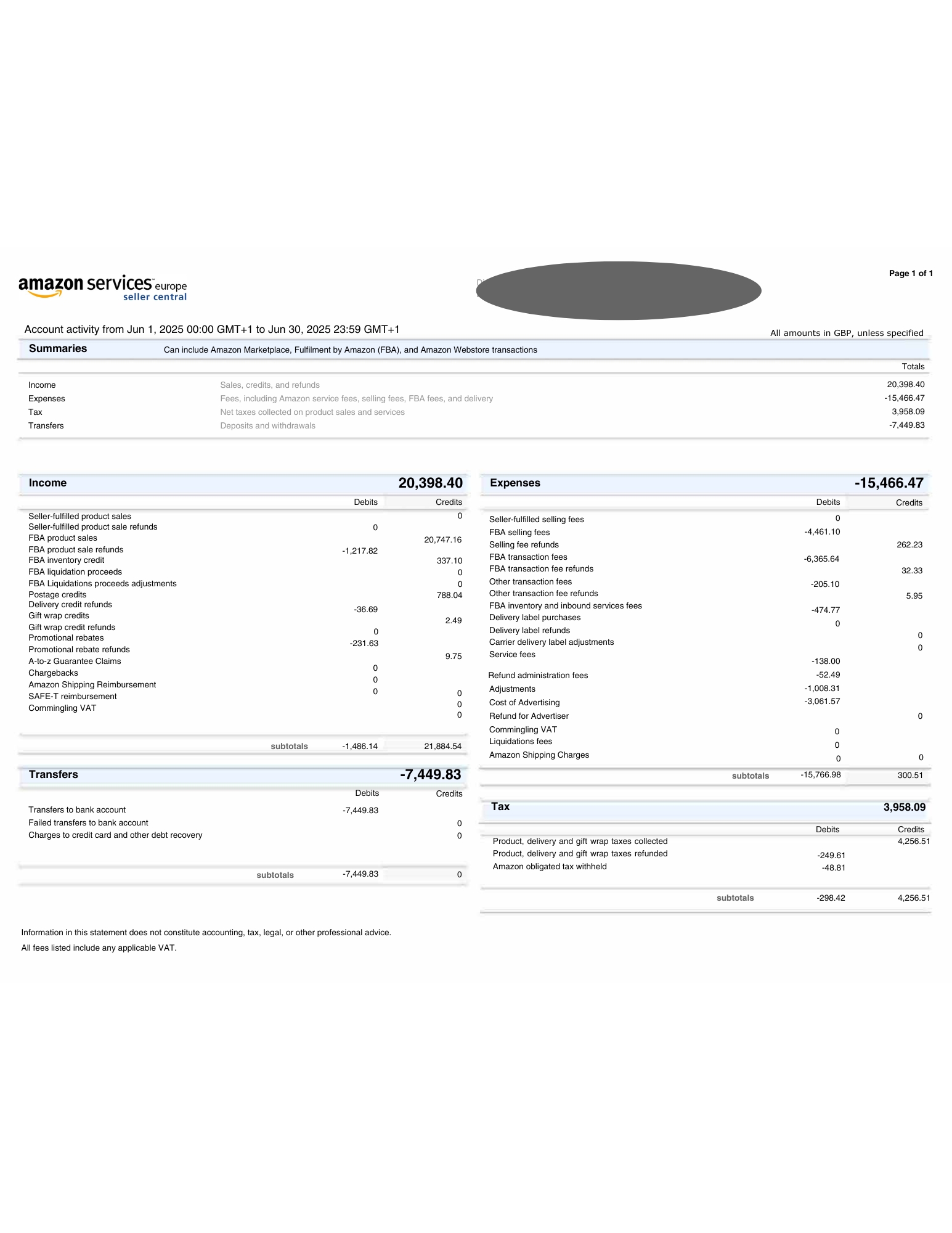

Hi guys, I'm very confused here when doing my profit calculation. Please tell me if I'm doing this right or wrong. I'm deducting the expenses from the income and then I deduct the COGS that was £5600. Doing it this way I'm making a loss that does not make sense as I have products that do well that sell for £25+. Can someone help me out here please.

Profit or Loss?

Hi guys, I'm very confused here when doing my profit calculation. Please tell me if I'm doing this right or wrong. I'm deducting the expenses from the income and then I deduct the COGS that was £5600. Doing it this way I'm making a loss that does not make sense as I have products that do well that sell for £25+. Can someone help me out here please.

0 replies

Seller_QuM1AZgzfU9x4

It's not clear whether the £5.6k is the cost of the units you actually sold or the total amount you spent on all goods which would mean you still have units to sell.

Regardless, you have over £3k in ad spend and £1k in adjustments showing. That's on top of having almost £11k in FBA fees for almost £21k in sales. So around half of your sales is going to fees then another fifth in ads / adjustments.

Not sure what your VAT situation is, but presumably you're registered so there's some accounting to do there.

Seller_76AUwmqvSyRIM

I haven't read through your figures but I was struck by this statement. I'm wondering why you believe that selling items for £25+ means that you will make a profit? The selling price is such is irrelevant. You could be selling something for £1 and making a profit (maybe not on Amazon) and you could sell something for £1000+ and make a loss.

Seller_ae51e0CJoHqCX

Yes it appears you are doing it right. It's hard to tell much without know your vat registration situation and the physical margins of each product.

You may have some high selling items with good GP but remember FBA is an expensive business especially when it comes to high volume tight margines products that can pull you into a loss making situation. Remember the old saying turnover is vanity but profit is sanity.

Also the amount that customers are now returning or claiming issues on products is rising so they can have them for nothing. Look at your product sale refunds, you have paid Amazon advertising as well as all the other selling fees and return postage etc if they can be bothered to send back.

It is really easy to oversell and find that you are gtting in over your head. You may have many products that sell well for over £25 but you need to go into your payments dashboard and have a look at transaction view.

You will be able to go down and scroll through some of the transaction whereby Amazon are simply taking up a lot of fee and these will not be worth selling. Also have a go on a few of the filters and look at your refunds, it will break down the returns and these are usually very heavy and Amazon biased. Believe itr or not that Amazon profit out of you if items are returned.

Seller_KlbXZHzQGSDZv

Ad revenue is an awkward one to deal with as your never sure how much your gonna spend out.

Best to work up a spreadsheet

ours begins with basic cost to us not in vat

ad the percentage we would like to see on our initial investment

add fees for postage in our case fba in yours

add vat

add 20% for amazon final value (I know its slightly less but this also covers us for other contingencies

and that should give you a figure for how much to price your item for now you could add a bit at this point for advertising or wait till you have sold 10 see how much the advertising cost and then add i on.

If your not doing something similar to this before adding your products you will either be overcharging and run the risk of not selling or undercutting yourself leading to problems down the line when your looking wow a trunover of 500k and a loss of 10k etc.

Seller_soBD2wwhsVOww

Going off those figures you are making a loss without even adding non amazon expenses.Amazon fees at 76% of Turnover would seem unsustainable to me.

You need to rethink your pricing/advertising strategy.

Seller_HFVt2oFsT0nRo

I would calculate as follows:

sales £20,398

expenses -£15,446

COGS -£5,600

Profit -£648

:

Seller_51Trj4jpVFZCy

Technically you will receive 8890.02. You should have some balance from that period.

So if that cogs is ex tax it will come to 5600+1120(VAT)

8890.02-3958.09(VAT)+1120(VAT for Goods)=6051.93 - 5600= £451.93 profit

If 5600 is inc VAT = 4666.66+ 934(VAT)

8890.02-3958.09(VAT)+934(VAT for Goods)=5865.93 - 4666.66= £1199.27 profit

Indy_Amazon

Hi @Seller_5DwnZw5Pr5Tgs,

Indy from Amazon's Community Management team jumping in here, nice to e-meet you.

I can see a lot of sellers have jumped in to answer your question already. Please let me know if I can provide any further support.

Best,

Indy

Seller_kjXDHcJtTU3MN

In short your selling prices are waaaay to low for those expenses.

Your advertising spend would appear to be too high, & I'd delve deeper into these figures....

FBA Selling Fees £4461.1

FBA Transaction Fees £6365.64

...get a handle on why they are so high.

I would disable your listings immediately (until you've got a grasp of this), because currently you've not just worked 3 months for nothing, you've actually worked 3 months to get poorer!

Seller_AVteysPitiEJq

I always download via Excel as I find this report isn't as accurate as the spreadsheet