Tax information

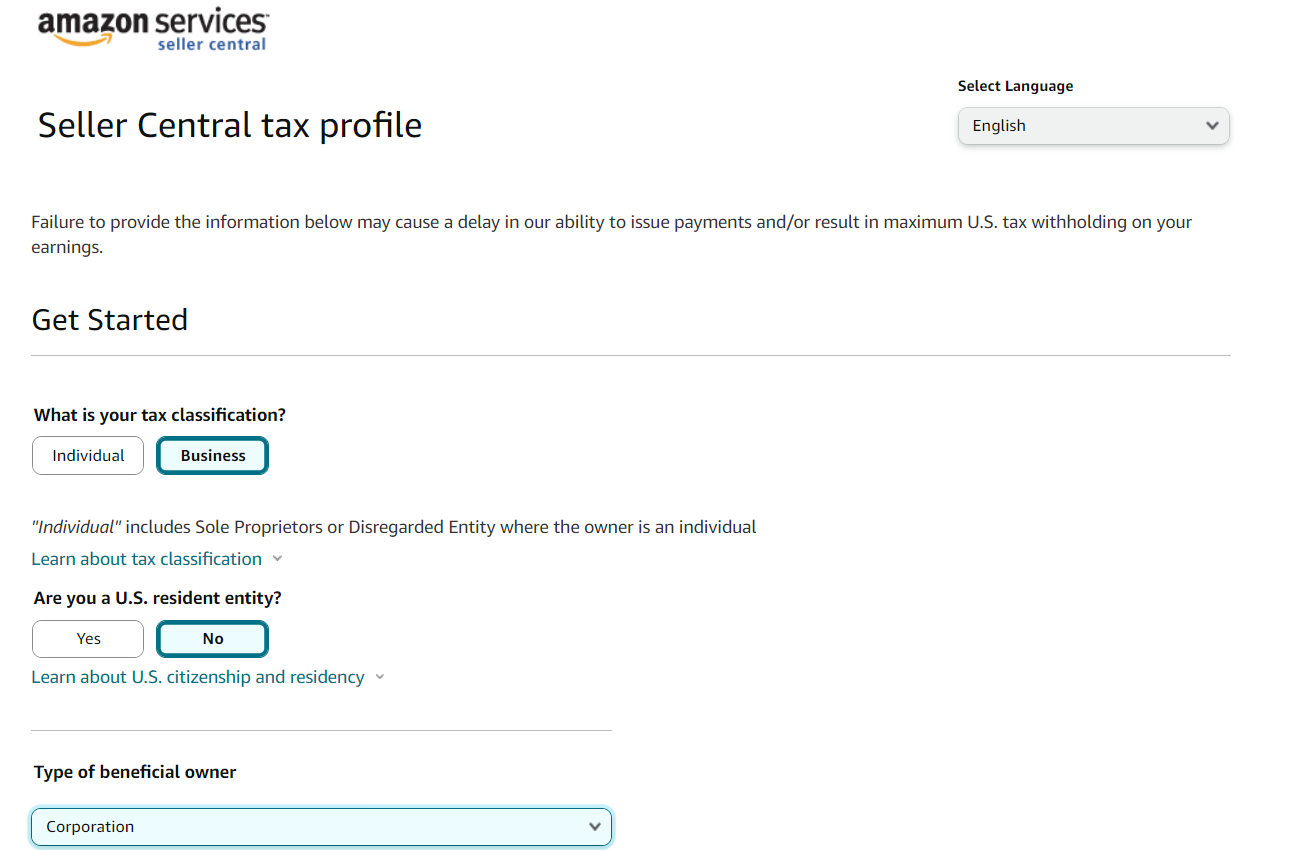

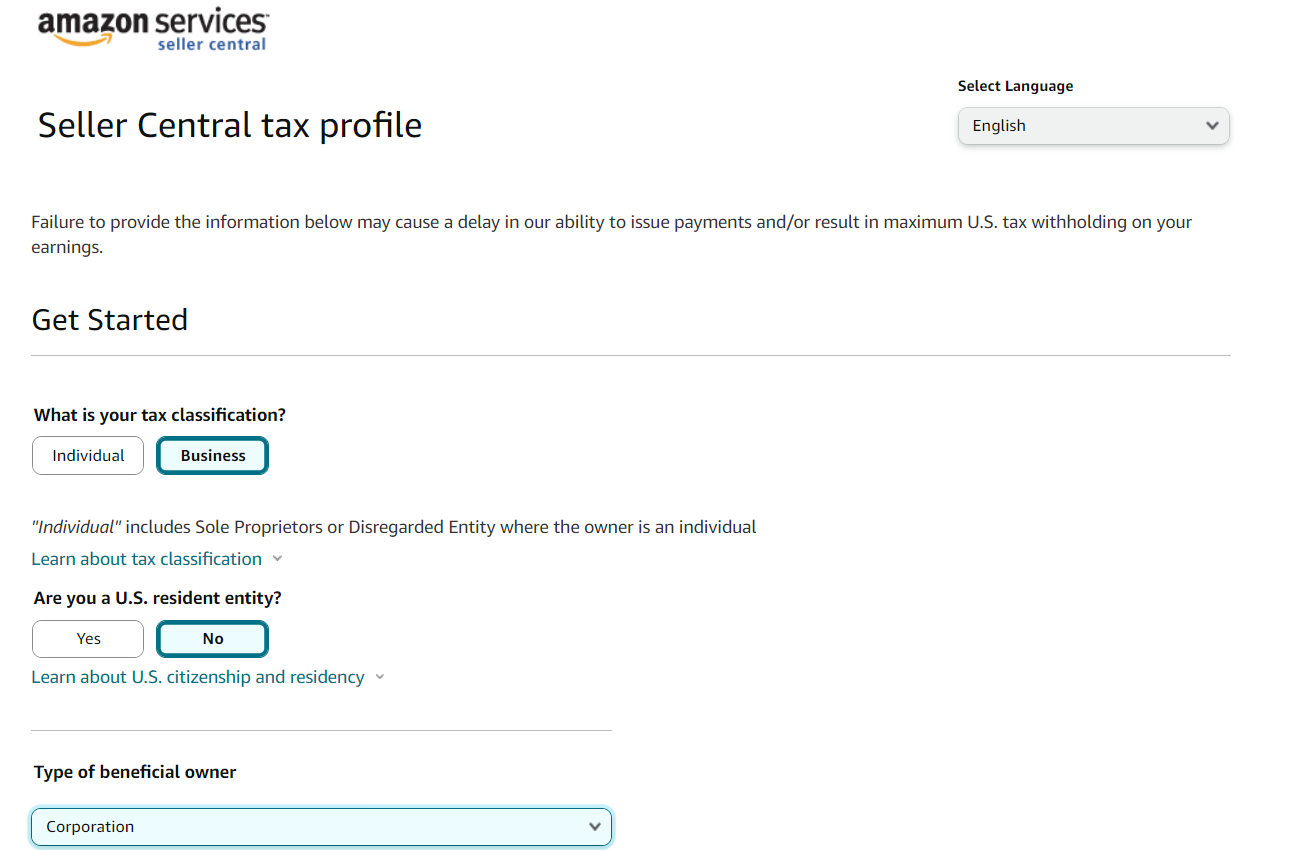

I want to complete this step in amazon seller central tax profile. so I have some questions:

- If someone is having LLC in US then which one is better to be select as tax classification?

- and if it is Business type so what beneficial owner should be selected for LLC and if it is individual so what beneficial owner should be selected?

Tax information

I want to complete this step in amazon seller central tax profile. so I have some questions:

- If someone is having LLC in US then which one is better to be select as tax classification?

- and if it is Business type so what beneficial owner should be selected for LLC and if it is individual so what beneficial owner should be selected?

0 replies

Micah_Amazon

Hello @Seller_1byEeZG5BSLs6,

Thank you for your post. While I am unable to provide specific tax advice, I have provided several resources below with more information on Amazon tax guidelines.

After review, if your question is still unanswered, I recommend that you create a case to Seller Support with your specific situation and they should be able to provide further guidance or engage the tax department.

Please let me know if you have any additional questions.

Cheers,

Micah